WWII Emergency War Housing

By Cindy Campbell, Director of PD&R's International and Philanthropic Affairs Division

Cynthia Campbell, Director of PD&R's International and Philanthropic Affairs Division.

Cynthia Campbell, Director of PD&R's International and Philanthropic Affairs Division.While helping to clear an archive storage area at HUD Headquarters, I found an interesting brochure titled, "Defense Housing, 1941." The brochure begins by noting that "soldiers and sailors need homes" and that the Federal Works Agency is charged with building these homes. The brochure states, "Any shortage of living facilities required to keep the defenders of the Nation and their families strong and alert tends to weaken the defense effort. Morale is as essential as equipment for the enlisted men of the Army, the Navy, and the Air Corps. Clean, decent, healthy living builds morale. Adequate defense housing, therefore, becomes an important part of the foundation upon which the superstructure of defense must rest. It is as much a function of the national Government as the production of munitions."

I love this quote because we all know that living in a safe, high-quality home is important. I lived in military housing several times during my career as a naval officer. The brochure also discusses the needs of defense workers. During World War II, thousands of Americans relocated to the urban areas that housed the nation's munitions factories. As the brochure mentions, when the United States entered the war, "tens of thousands of workers answered the call for men to build planes, battleships, tanks, guns, machine tools, precision instruments and the thousand and one other things needed for national defense. As they swarmed into industrial centers, the supply of decent living accommodations soon became exhausted. Families were forced to live in ramshackle houses under slum conditions. Two or more families to a house. Houses with leaking roofs but no running water. Other families forced to live many miles from factories and workshops in insanitary wooden shacks, with only tar paper on the walls. Thousands of new homes were needed."

The United States Housing Authority (USHA) was established in 1937 to oversee low-income public housing. In 1939, the USHA was transferred to the Federal Works Agency. From the declaration of war until the end of World War II, the Federal Works Agency led a massive campaign to house factory workers. In 1942, USHA was renamed the Federal Public Housing Authority (FPHA) and transferred to the National Housing Agency. In 1947, FPHA was replaced by the Public Housing Administration, which in turn was replaced by the U.S. Department of Housing and Urban Development in 1965.

An interesting FPHA report from June 1945 titled "Public Housing During the War: The Work of the Federal Public Housing Authority" describes how the U.S. government created all this housing during World War II. Under the heading "The Wartime Job of FPHA," the report notes, "Since February 1942, the production and management of public war housing has been primarily the job of the Federal Public Housing Authority, which was set up for that purpose as a unit of the National Housing Agency by an Executive Order of the President. By the beginning of 1945 the FPHA had provided close to 700,000 war housing dwelling units, including some that had been built by other agencies and transferred to FPHA for management. The FPHA program makes up four-fifths of all public war housing provided, totaling nearly 900,000 units."

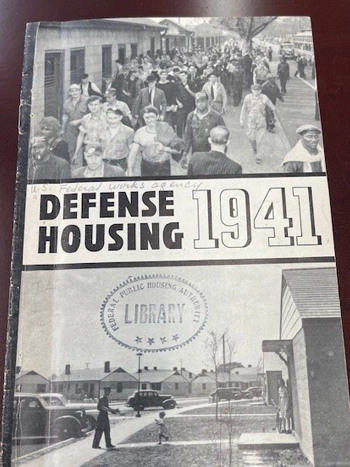

During the Second World War, the federal government strove to ensure a sufficient amount of safe, high-quality housing for workers laboring on the home front to supply the nation's war effort, describing its efforts in this brochure from 1941.

During the Second World War, the federal government strove to ensure a sufficient amount of safe, high-quality housing for workers laboring on the home front to supply the nation's war effort, describing its efforts in this brochure from 1941.

The "Defense Housing, 1941" brochure highlights a case study involving Elmer Honeycutt, a trained operator of machine tools who lived with his wife and two children in San Francisco. Honeycutt volunteered to move to San Diego to work in an aircraft manufacturing plant. The brochure notes that 100,000 people moved to San Diego for the war effort. Honeycutt could only rent a two-room tourist cabin that had been condemned. The entire family had to sleep and live in those two rooms and use a communal toilet facility that served 50 people. In response to such needs, the Federal Works Agency created the Linda Vista housing project in the city, which, according to one article by historian Mary Taschner, involved building 3,000 houses in just 300 days. Linda Vista was America's largest defense housing project. The massive project created some areas of concern for the city of San Diego, which lacked the infrastructure to handle the huge influx of defense workers.

The brochure includes photos of the happy Honeycutt family in their new two-bedroom home overlooking the Pacific Ocean, meeting their neighbors in their living room. Most of the homes built for the Linda Vista housing project still exist. I was stationed in San Diego and remember this neighborhood well, because it was just up the road from my home. Homes in this complex now sell for more than $1 million and look nearly identical to the one in the brochure.

The brochure details how these homes were built, noting that they will be "economically built to the American standard for defenders of democracy." It then discusses how the Federal Works Agency ensured that the selected sites were not only close to the defense activity but also to schools, churches, and retail. The designers brought to bear "the latest knowledge and experience in their field to plan real homes with pleasant environment and modern conveniences."

It is interesting that the very end of the brochure contains a section titled "Ghost towns vanish," which addressed concerns about what would happen to this housing after the war ended. "Future needs as well as immediate requirements influence the selection of [Federal Works Agency] defense housing project sites. To prevent, so far as possible, the growth of ghost towns and to guard against a surplus of vacancies in the post emergency period that would depress real estate values, demountable houses are being built in some localities. These dwellings can be removed when they are no longer required and set up elsewhere to meet a new housing need or to serve some other useful purpose."

The legacy of the war housing efforts can be seen beyond San Diego's city limits; many of these housing developments still exist throughout the United States. Without the efforts of the Federal Works Agency and its successors, these homes would never have been built. The agency's hard work contributed directly to the war effort and should not be forgotten.